Higgins Corporation budgets for a monthly manufacturing overhead cost of $100,000, which it plans to apply to its planned monthly production volume of 50,000 widgets at the rate of $2 per widget. In January, Higgins only produced 45,000 widgets, so it allocated just $90,000. The actual amount of manufacturing overhead that the company incurred in that month was $98,000. Assigning costs involves dividing the usage measure into the total costs in the cost pools to arrive at the allocation rate per unit of activity, and assigning overhead costs to produced goods based on this usage rate. If the management isn’t taking all fixed costs into consideration when valuing the true cost of producing inventory, the sales price might be too low and the company might actually be losing money on every product sold.

Common Absorption Costs Found in Manufacturing Businesses

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial a complete guide to net payment terms content. If a job involves direct wages of $1,000, the overhead to be absorbed amounts to $500 (i.e., 50% of $1,000). Tools like Katana help address these challenges, providing real-time insights into inventory, assisting with inventory optimization, offering scenario analysis tools, and automating cost tracking.

- Absorption costing provides a more true image of profitability for a company.

- It is possible to use activity-based costing (ABC) to allocate overhead costs for inventory valuation purposes under the absorption costing methodology.

- It is then utilized to calculate the cost of products produced and inventories.

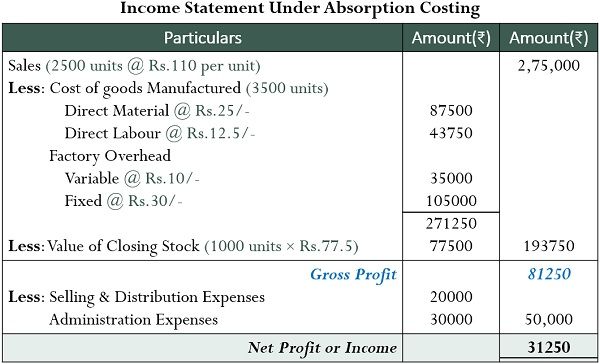

- In summary, absorption costing provides a full assessment of production costs for inventory valuation, while variable costing aims to show contribution margin and provide internal reporting.

- Overhead is usually applied based on a predetermined overhead allocation rate.

When Is It Appropriate to Use Absorption Costing?

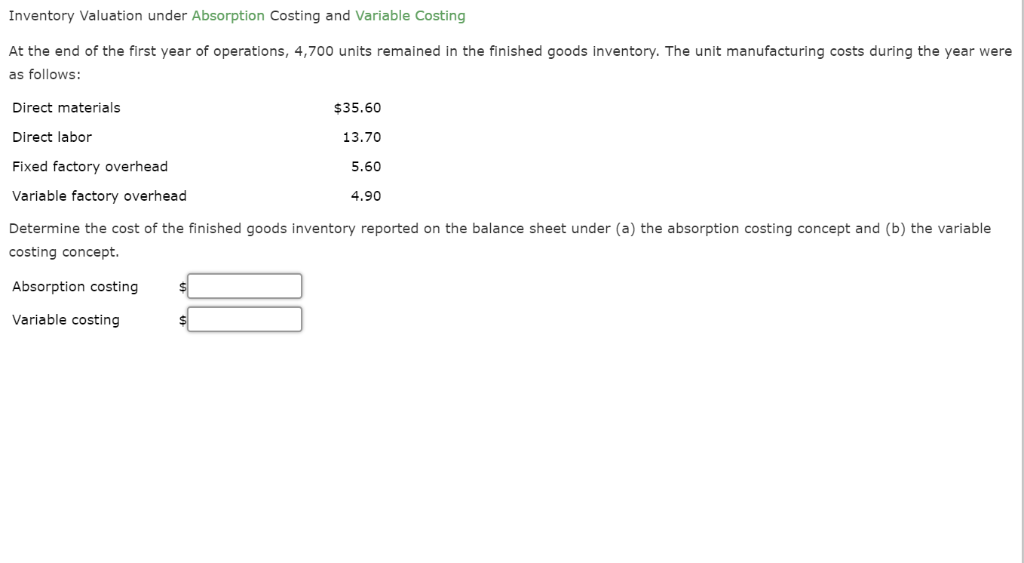

Companies using absorption costing must understand these inventory valuation implications for accurate financial statement analysis when production volumes change. Since more costs are capitalized into inventory under absorption costing, the cost of goods sold recognized on the income statement tends to be lower in periods of rising production or increasing inventory levels. In summary, absorption costing provides a comprehensive view of production costs for improved decision-making, even though net income may fluctuate more between periods. Mastering these mechanics can lead to GAAP-aligned and incremental accounting. Consequently, net income tends to be higher under variable costing when production exceeds sales, and lower when sales exceed production. Despite differing income statement impacts, absorption costing adheres to GAAP while variable costing does not.

Need Help with Proper Absorption Costing?

But absorption costing net income is viewed as more accurate since it allocates all production costs. Revenue is recorded in the same way under both absorption costing and variable costing. It reflects the sales made during the period at the price agreed upon with customers. There is no difference in revenue recognition between the two costing methods.

Absorption costing means that ending inventory on the balance sheet is higher, while expenses on the income statement are lower. It is rare for applied overheads to agree with actual overheads; a difference is always likely to exist. If the absorbed amount exceeds the actual overhead, the difference is termed overapplied overhead. If 25 hours are spent on a job, then the absorption on the job will be of $0.2 x 25 hours (i.e., $5). This method should be applied when labor is the main factor of production. The percentage is obtained by dividing the overhead cost by the amount of direct labor.

Evaluate the price of a product’s manufacture first, and then divide them into distinct cost pools. In practice, if your costing method is using Absorption Costing, you are expected to have over and under absorption. This article will discuss not only the definition of absorption costing, but we will also discuss the formula, calculation, example, advantages, and disadvantages. Absorption costing is also known as full absorption costing or full costing. Absorption costing results in a higher net income compared with variable costing.

For example, if the overhead rate is predetermined to be $20 per direct labor hour consumed, but the actual amount should have been $18 per hour, then the $2 difference is considered to be over absorbed overhead. It may be beneficial to use the variable costing method depending on a company’s business model and reporting requirements or at least calculate it in dashboard reporting. Managers should be aware that both absorption costing and variable costing are options when reviewing their company’s COGS cost accounting process. Absorption versus variable costing will only be a factor for companies that expense costs of goods sold (COGS) on their income statements. Any company can use both methods for various reasons but public companies are required to use absorption costing due to their GAAP accounting obligations.

Under absorption costing, the fixed manufacturing overhead costs are included in the cost of a product as an indirect cost. These costs are not directly traceable to a specific product but are incurred in the process of manufacturing the product. In addition to the fixed manufacturing overhead costs, absorption costing also includes the variable manufacturing costs in the cost of a product.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.